Charitable giving is a meaningful way to make a difference in the world while also reaping potential financial benefits. For individuals and families with significant wealth or a desire to create a lasting philanthropic legacy, donor-advised funds (DAFs) and charitable trusts offer powerful tools to structure giving efficiently and effectively. Here’s a closer look at how these options work and how they can support your philanthropic goals.

What Are Donor-Advised Funds (DAFs)?

A donor-advised fund (DAF) is a simple and flexible way to give to charity. Think of it as a charitable giving account where you can contribute assets, get an immediate tax deduction, and then recommend grants to your favorite causes whenever you’re ready.

One of the biggest perks of a DAF is the immediate tax deduction—you can deduct the full value of your contribution in the year you make it, as long as it meets IRS limits. Plus, you’re not required to donate the funds right away. Instead, you can invest the balance, allowing it to grow over time and potentially make an even greater impact.

DAFs are also incredibly easy to use since the sponsoring organization handles all the admin work, like record-keeping and compliance. Another nice touch? You can choose to make your donations anonymously if you prefer to keep your giving private. This makes DAFs a great option for people who want a straightforward way to manage their charitable contributions. They’re especially useful if you’ve had a financial windfall, like a bonus, stock sale, or inheritance, and want to offset taxes. And if you like the idea of supporting different charities over time while keeping things flexible, a DAF might be just what you’re looking for.

What Are Charitable Trusts?

Charitable trusts are a smart way to combine philanthropy with financial planning. These legal entities hold and manage assets specifically for charitable purposes and are often used by high-net-worth individuals to integrate giving into their estate plans. There are two main types of charitable trusts to consider.

A Charitable Remainder Trust (CRT) lets you or other beneficiaries receive income from the trust for a certain period or even a lifetime. Once the term ends, the remaining assets go to a designated charity, and you get a tax deduction based on the future value of that donation. On the other hand, a Charitable Lead Trust (CLT) works in reverse—it provides income to a charity for a set time, after which the remaining assets are passed on to your heirs or beneficiaries, making it a great tool for reducing estate and gift taxes.

The benefits of charitable trusts go beyond tax savings. CRTs can offer an ongoing income stream, which can be especially helpful for retirement planning. Both CRTs and CLTs are highly tax-efficient, potentially reducing estate and capital gains taxes while also providing a charitable deduction. Plus, they allow you to build a multigenerational giving legacy, aligning your family’s wealth with your values.

Charitable trusts are particularly appealing for individuals with highly appreciated assets who want to avoid hefty capital gains taxes, those looking to balance personal financial needs with charitable goals, and families aiming to create a lasting philanthropic legacy.

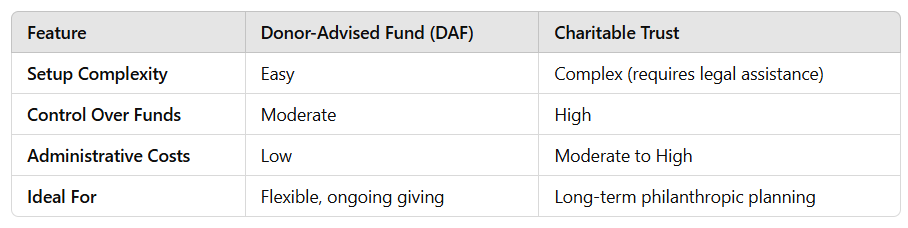

Comparing DAFs and Charitable Trusts

Making the Choice: Which Is Right for You?

Choosing between a donor-advised fund and a charitable trust depends on your financial situation, philanthropic goals, and the level of control you desire. Consider the following:

- For simplicity and flexibility: A DAF is a great option if you want to start giving quickly without legal complexity.

- For large or complex gifts: A charitable trust is often better suited for managing significant assets, like real estate or business interests.

Navigating the complexities of charitable giving requires thoughtful planning, and a financial advisor can be an invaluable resource. They can help you assess your financial goals and recommend the best strategies for achieving them. By working closely with your tax and estate planning professionals, they can also ensure you maximize tax benefits while staying aligned with your overall financial plan.

Whether your passion lies in supporting education, protecting the environment, or advancing health initiatives, tools like donor-advised funds and charitable trusts can enhance your impact and help you create a lasting legacy.

Are you ready to discuss what option(s) might be right for you? CLICK HERE to make an appointment.