With all the ups and downs the market has experienced (with a splash of inflation thrown in), it’s not unusual for financial planning clients to question their portfolio performance. And we understand that – the last few years have brought more uncertainty than anyone could have anticipated.

In fact, if we had had a crystal ball in 2019 and it showed us everything that was about to happen…we still wouldn’t have believed it. Let’s take a quick look:

- Early 2020 – First global pandemic in 100 years began

- March – S&P 500 entered bear market for first time since the Great Financial Crisis

- February 2022 – Worst European land war in 70 years began

- July 2022 – Highest inflation rate in about 40 years

- March 2023 – Three of the four largest bank failures in US history occurred

- July 2023 – Federal Reserve raised Federal Funds Rate to the highest level since March 2001

- October 2023 – War breaks out in the Middle East

So, sure. If you’re one of those people who looks at their accounts every day, you might have experienced some whiplash along the way.

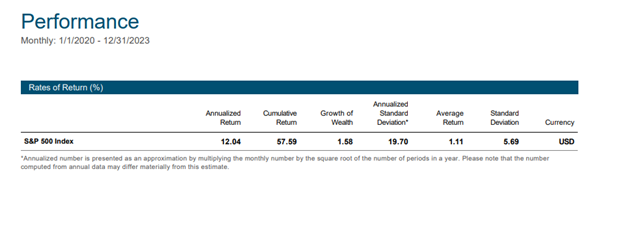

However, the S&P 500 Index provided an annualized return of 12.04% between January 1, 2020, and December 31, 2023.* This means that things might not be as depressing as you think they are.

Big Picture Planning

Financial markets are inherently reactive to the ever-changing economic and geopolitical environment. Major events, such as interest rate changes, political upheavals, or global pandemics, can have profound effects on market performance. Investors often find themselves at the mercy of short-term fluctuations that result from knee-jerk reactions to these events.

However, it’s important to remember that markets are fundamentally cyclical and tend to recover over the long term. History has shown us that even in the face of major crises, markets have a remarkable ability to bounce back. This is why investors need to maintain a broader perspective and not be swayed by the daily noise.

It’s also important to keep every financial planner’s favorite word in mind: diversification. By spreading investments across different asset classes, industries, and geographic regions, investors can reduce the impact of any single event or market downturn on their overall portfolio. This risk management approach enhances resilience and helps maintain a long-term perspective.

Avoid Emotional Decision-Making

We understand that daily market fluctuations can evoke strong emotional responses, leading investors to make impulsive decisions that may not align with their long-term goals. Panic selling during a market downturn or FOMO (Fear of Missing Out) and buying during a bull run are common pitfalls that can undermine investment success.

A focus on the big financial picture helps investors overcome emotional biases by providing a rational framework for decision-making. This approach encourages discipline, patience, and a commitment to the long-term strategy, reducing the likelihood of succumbing to short-term market noise. It also helps to work with a financial advisor who can talk you down from the emotional ledge when you feel panicked about how current events might affect your portfolio.

Bottom Line

We know that there’s a lot to worry about these days; the news is filled with one crisis after another. However, when it comes to your portfolio, the overall picture might not be as bleak as you’re assuming.

We’re here to help our clients identify opportunities that may be obscured by daily fluctuations, enabling them to make informed decisions based on the underlying strength of an investment. We’re also here to make sure that they can weather short-term volatility and position themselves for long-term success.

Do you have questions about your portfolio? We’re here to help. CLICK HERE to make an appointment.

*Performance data shown represents past performance. Past performance is no guarantee of future results and current performance may be higher or lower than the performance shown. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Average annual total returns include reinvestment of dividends and capital gains. Indices are not available for direct investment and performance does not reflect expenses of an actual portfolio.

All opinions expressed in this blog post reflect the judgment of Approach Retirement Advisors, LLC (“Approach”) as of the date of publication and are subject to change. The information in this blog post is believed to be factual and up to date; however, we do not guarantee its accuracy. This blog post should not be regarded as a complete analysis of the subjects discussed. This presentation is for educational purposes only and does not constitute personalized investment advice. A professional advisor should be consulted before implementing any of the strategies presented. This blog post should not be construed as an offer to buy or sell or as a solicitation of any offer to buy or sell any securities mentioned herein. Clients and members of Approach may own any securities mentioned herein. Investments are subject to market risks and potential loss of principal invested, and all investment strategies have the potential for profit or loss. Past performance is no guarantee of future results. Different types of investments involve varying degrees of risk. There can be no assurance that any specific investment will be suitable or profitable for a particular investor’s portfolio. There are no assurances that any portfolio will match or outperform any particular benchmark.